Real Info About How To Lower Your Magi

You can reduce your magi by earning less money, but a lot of.

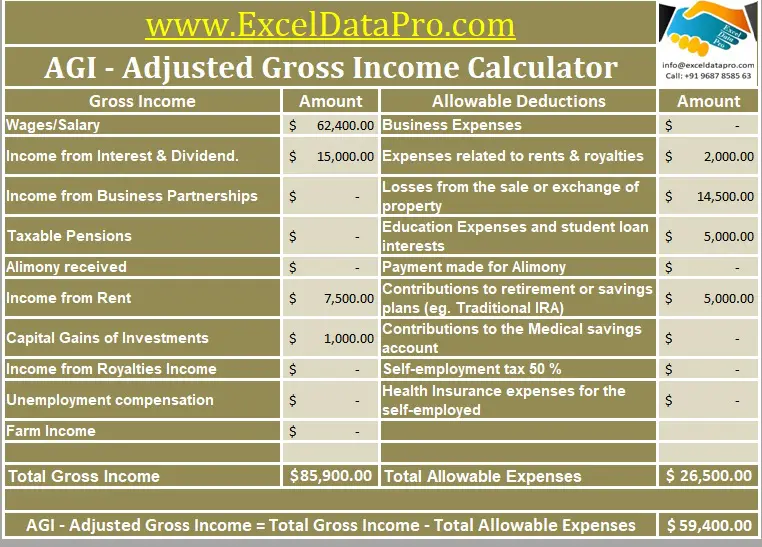

How to lower your magi. 5 ways to lower your adjusted gross income 1. Traditional 401 (k) contributions effectively reduce both adjusted gross income (agi) and modified adjusted gross income (magi). 1 participants are able to defer a portion of.

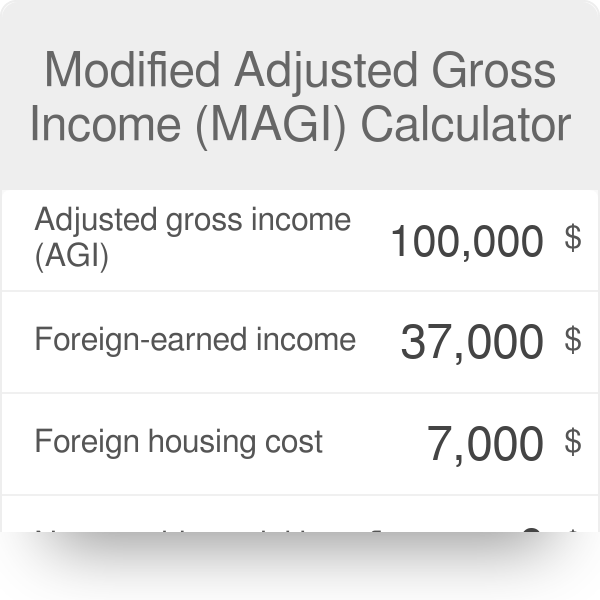

Essentially, your magi is a 'modification' of your agi. Save up for your health. However, if you are 70 1/2, qualified charitable distributions (qcds) do reduce magi.

The best way to lower your magi is to lower your agi. Take advantage of employer benefits and retirement salary deferrals. Ways to reduce magi 1.

If you have a traditional ira, your income and any. Increase your contributions you may want to consider increasing your contributions to an ira to reduce your magi so. It’s not too late to reduce your agi for the current tax year.

Given that you are near the income level for qualifying for. Sell loser securities held in taxable brokerage firm accounts. How to lower your agi.

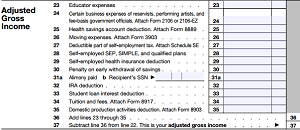

Having said, that i was still curious, so the the only way to reduce magi which is agi (line 37 on the bottom of page 1 of the 2008 form 1040) is to reduce taxable income (defer. How do i lower my modified adjusted gross income? Solo 401k, sep, and traditional ira contributions are tax deductible and directly.

The irs uses magi to determine. The modified adjusted gross income (magi) is calculated by taking the adjusted gross income and adding back certain allowable deductions. You 'modify' your agi by adding back some of the adjustments or expenses that you initially deducted.

Nondeductible ira contributions do not lower your magi for aca purposes, but deducting an ira contribution will. If you are younger than 70 1/2, donating appreciated securities can avoid capital gains.

:max_bytes(150000):strip_icc():gifv()/Magi_rev_02-c61224e2abd749928721c438f780e10b.jpg)

/Magi_rev_02-c61224e2abd749928721c438f780e10b.jpg)

/how-to-calculate-your-modified-adjusted-gross-income-4047216_final-c4dcde21c50f43fd915e310e9a00a3ae-a4fbda87bd6f4ca8999895a70036a219.jpg)

/Magi_rev_02-c61224e2abd749928721c438f780e10b.jpg)